Determining whether to buy a house involves weighing financial, lifestyle, and market factors. This decision demands careful analysis to align with long-term goals.

Pros of Buying a House

- Builds Equity: Ownership allows accumulating wealth through property appreciation and mortgage payments.

- Stable Housing Costs: Fixed-rate mortgages shield from rent fluctuations, offering predictable expenses.

- Tax Advantages: Potential deductions on mortgage interest and property taxes reduce taxable income.

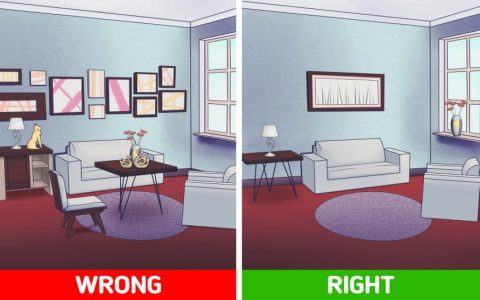

- Personal Freedom: Customize and renovate without landlord restrictions.

- Investment Potential: Real estate can generate rental income or sell for profit in appreciating markets.

Cons of Buying a House

- High Upfront Costs: Requires down payment, closing fees, and inspection expenses.

- Ongoing Maintenance: Responsible for repairs, upkeep, and unexpected emergencies.

- Reduced Flexibility: Difficult to relocate quickly for job changes or personal reasons.

- Market Volatility Risk: Property values may decline due to economic downturns.

- Long-Term Debt: Mortgages commit to decades of payments, increasing financial strain.

Evaluate personal finances, market conditions, and life plans to make an informed choice.