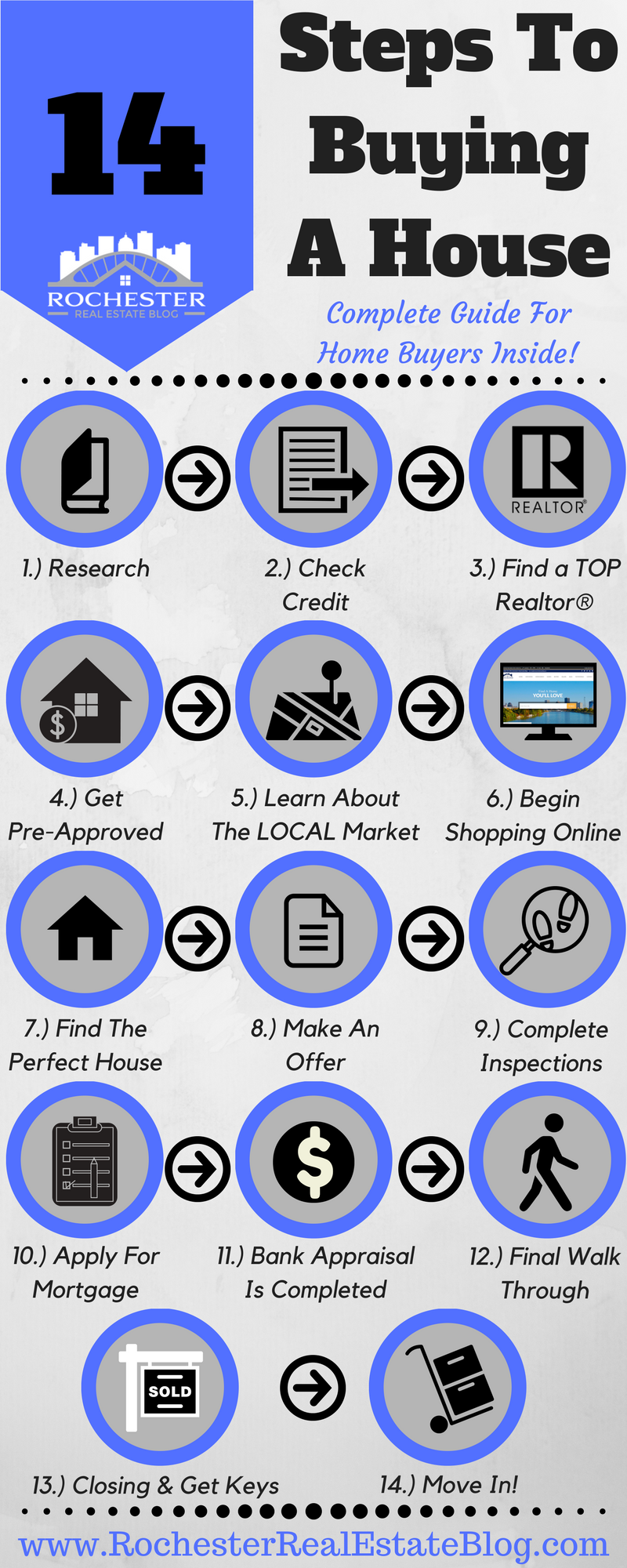

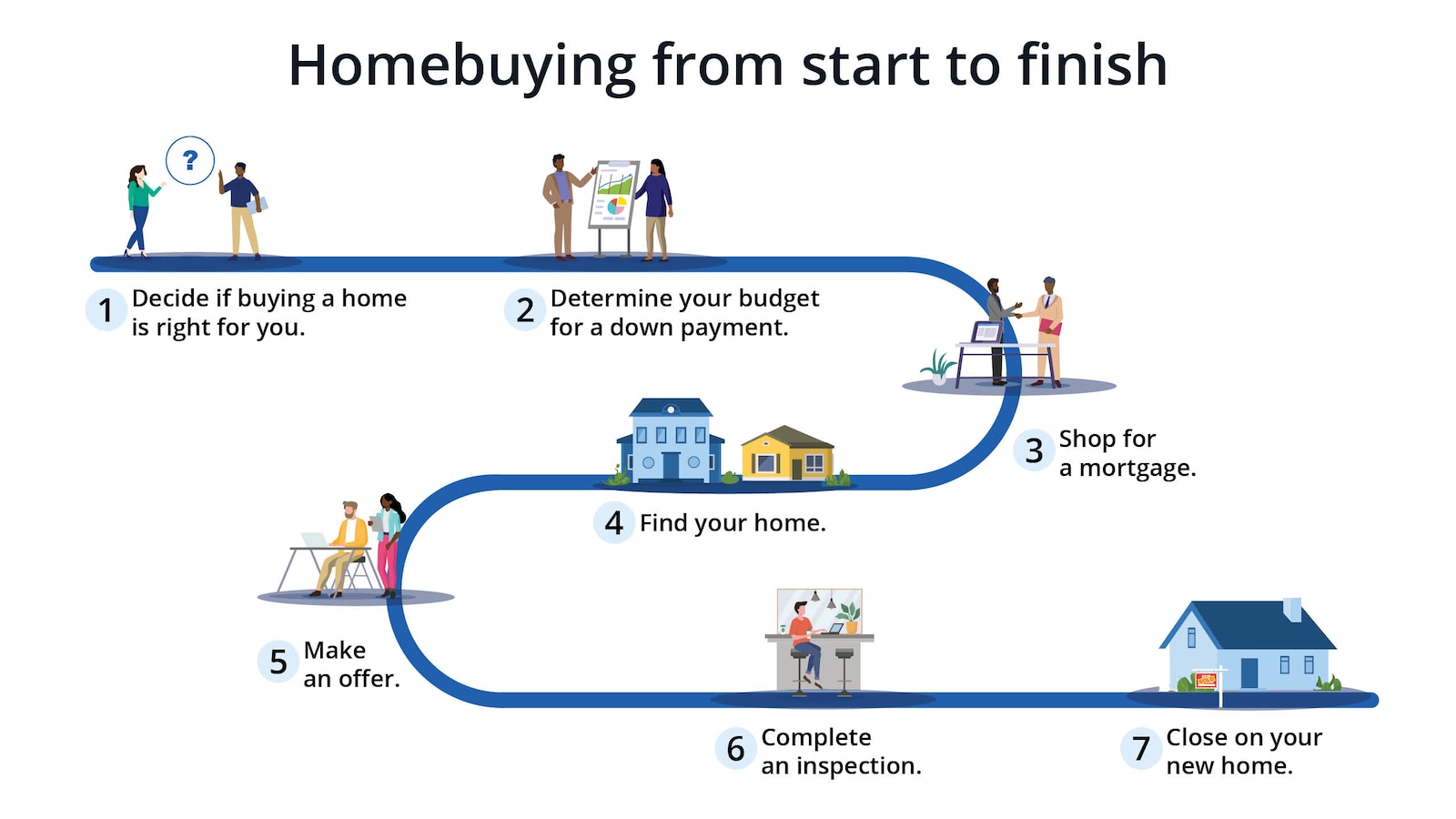

Purchasing a home in Pas requires a systematic approach. Follow these essential steps for success:

Pre-Purchase Financial Preparation

Audit Your Finances: Scrutinize your income, debts, credit score, and savings. Aim for a credit score above 700 for optimal loan terms.

Secure Mortgage Pre-Approval: Obtain a lender's written pre-approval detailing your maximum loan amount and interest rate. This is crucial before viewing properties.

Determine Your Budget: Factor in down payment (ideally 20%), closing costs (typically 2-5% of purchase price), property taxes, insurance, homeowners association fees, and ongoing maintenance.

Property Search & Selection

Define Requirements Clearly: List non-negotiable features (bedrooms, location, school district) and desirable extras. Prioritize proximity to amenities, work, and infrastructure.

Partner with a Local Real Estate Agent: Choose an experienced agent specializing in Pas neighborhoods. They provide crucial MLS access, comparative market analyses, and negotiation expertise.

Conduct Rigorous Property Viewings: Inspect potential homes thoroughly. Assess structural integrity, mechanical systems (HVAC, plumbing), layout functionality, and potential renovation costs.

Offer Submission & Negotiation

Formulate a Competitive Offer: Your agent will analyze comparable sales to suggest a strategic offer price. Decide on contingencies (financing, inspection, appraisal) and proposed closing timeline.

Negotiate Terms: Be prepared for counteroffers. Negotiation may involve price, closing cost credits, repairs, or inclusion of specific appliances.

Execute Purchase Agreement: Once terms are accepted, both parties sign a legally binding purchase agreement outlining all conditions.

Due Diligence & Closing

Schedule Professional Inspections: Hire licensed inspectors for general, pest, radon, and specialized assessments (e.g., sewer scope, foundation). Review reports meticulously.

Appraisal & Mortgage Underwriting: The lender orders an appraisal to confirm the property's value. Provide all requested documentation promptly to underwriters.

Final Walkthrough: Conduct this 24 hours before closing. Verify property condition matches the contract and requested repairs are complete.

Closing Process: Sign extensive legal and loan documents. Bring valid ID and certified funds for closing costs and down payment. Keys transfer upon recording at the county office.

Post-Purchase Considerations

- Title Insurance Protection: Ensures clear property ownership history.

- Property Tax & Insurance Setup: Ensure escrow account is correctly established or plan for direct payments.

- Long-Term Home Maintenance Plan: Budget annually (1-3% of home value) for upkeep and unexpected repairs.